OptimalData consulting provides data conversion services for organizations implementing NetSuite.

NetSuite, Implementation, Data Migration

January 10, 2024

4 min Read

NetSuite | Full transaction import case study - Akouos

Importing historical financial data is a critical component of the NetSuite implementation process. Generally, there are two approaches:

-

Net change journal entry - import a journal entry to record the period balance with some combination of GL account, department, class, and vendor/customer.

-

Full transaction - import historical financial transactions into NetSuite from the legacy system.

Companies often request approach # 2. This approach preserves the company's transaction history and removes the need to maintain access to the legacy ERP system. Reports ran from NetSuite will include all the details, easing the pain come audit time.

"[OptimalData] managed the accounting system implementation process for Akouos, Inc. The company migrated from QuickBooks Online to NetSuite. The implementation was a smooth process and we were up and running very quickly. We would highly recommend Paul as a NetSuite implementation partner." - Mary LeBlanc, VP of Finance

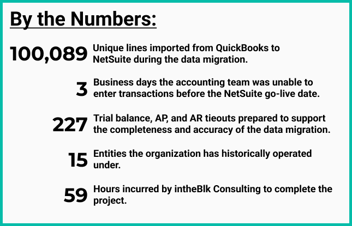

OptimalData completed a full transaction import for Akouos' NetSuite implementation. Akouos is a precision genetic medicine company focused on developing gene therapies that restore and preserve hearing.

Here is the profile of Akouos' NetSuite implementation:

-

ERP system: QuickBooks Online (QBO)

-

Transaction Types used: Bill, Bill Payment (Check), Bill Payment (Credit Card), Check, Credit Card Credit, Credit Card Expense, Deposit, Expense, Journal Entry, Transfer, Vendor Credit

-

Transaction volume: Approximately 22,000 lines of transaction data, or 3.5 years of transactions

-

Purchasing system: Prendio/BioProcure (PO history preserved in Prendio)

-

NetSuite implementation partner: Sikich (Life Sciences SuiteSuccess)

-

Implementation timeline: 10 weeks

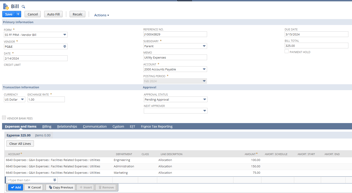

One challenge with a full transaction import is that NetSuite and the legacy ERP field requirements differ. For example, in QBO, a Check transaction does not require a payee. In NetSuite, a Check transaction requires a payee. This difference means that an exact 1:1 transaction match is not possible. Here is how intheBlk mapped record types:

|

QBO Transaction Type |

NetSuite Transaction Type |

Rationale |

|

Bill |

Vendor Bill |

|

|

Bill Payment (Check), Bill Payment (Credit Card) |

Vendor Payment |

|

|

Vendor Credit |

Vendor Credit |

|

|

Journal Entry, Transfer, Expense |

Journal Entry |

NetSuite does not support importing bank transfers via a CSV import; Expense transactions in QBO don't require an employee field. NetSuite requires the employee field. |

|

Check, Credit Card Credit, Credit Card Expense, Deposit |

Monthly net journal entry (imported as Journal Entry) |

In QBO, a Check does not require a payee. NetSuite requires a payee. All other transactions included here were immaterial, and the client was comfortable combining them into one net monthly JE. |

OptimalData completed the following during the implementation:

-

Created the segment map file, which linked the QBO GL accounts, classes, and vendors to the NetSuite GL accounts, departments, classes, and vendors

-

Exported required reports from QBO

-

Created CSV import files for individual journal entries, vendor bills, vendor payments, vendor credits, and a net monthly journal entry

-

Completed tie-out procedures on the accounts payable detail listing, income statement by GL account and class, and balance sheet by GL account

Would your company like to bring the entire financial history into NetSuite? If so, contact OptimalData for a free consultation or see our data conversion overview page. We can help you with the challenging task of converting historical financial data into NetSuite.