Systems, NetSuite, Integrations

January 10, 2024

4 min Read

Data migration implications of Bill.com's initial sync with NetSuite

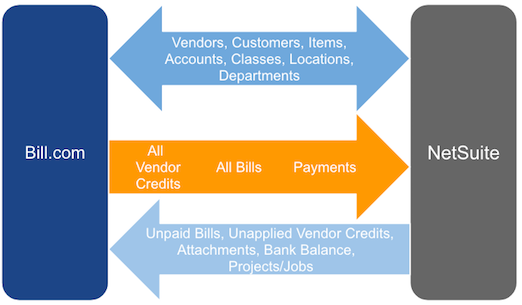

Bill.com is an excellent tool for creating and paying vendor bills. However, there are several implications to the data migration strategy if you plan to sync Bill.com with NetSuite. We specifically discuss managing payables in this article.

First, as with any integration, you will want to communicate with customer support that you are implementing NetSuite. The initial sync requires an implementation appointment. You can find the link in Bill.com's documentation. The documentation includes all these details, and your customer sales rep will walk you through how to complete this process.

The data will sync in three stages:

-

Vendors,

-

Segment structure

-

Open transactions

Each stage is discussed further below.

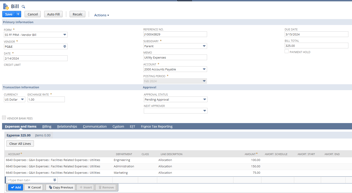

image from Bill.com's Sync documentation

image from Bill.com's Sync documentation

Vendors:

There are two options for loading vendors into NetSuite with Bill.com. You can either:

-

use the Bill.com sync to generate vendor records or

-

upload the Bill.com vendor list into NetSuite via a CSV vendor template.

The benefit of using the sync to generate vendors is users avoid needing to prepare and upload the vendor data. The downside is that Bill.com won't create the vendor records until after the initial sync, which is typically done a week before the go-live date. This downside isn't relevant if you are loading historical data with a net change journal entry. However, if you are loading historical transactions, you will need to factor this into your timeline. If you are interested in learning more about loading historical transactions, check out this article.

If you decide to preload vendors into NetSuite, the company name (for companies) or first and last name (for individuals) must correspond to Bill.com exactly. Otherwise, the records will not match, and Bill.com will generate a duplicate vendor record when you complete the initial sync.

Segments:

Bill.com will pull the segment structure from NetSuite for future transactions. Any open payables will include the segment structure from the legacy system. I'd recommend inactivating the old segments before syncing the new segment structure from NetSuite. There is no need to adjust the open payable segment structure to match the new NetSuite structure.

Transactions:

Bill.com will create the transactions comprising the open payables balance. This push includes fully unpaid vendor bills and credits but excludes partially applied transactions. If you have partially used transactions, create a dummy credit/bill to clear out the partially applied transaction and make a new transaction for the net amount.

All imported transactions will post to a suspense account on the trial balance (i.e., debiting a suspense account and crediting accounts payable). The sync does this because of the changed segment structure. If you imported historical transactions using the net change approach, eliminate this balance with a single journal entry debiting accounts payable and crediting the suspense account. If you imported historical transactions using the net change approach, you need to either:

-

Replace the AP account with the suspense account on any imported AP transaction.

-

Exclude the open AP transactions from the historical financial load. You will want to use the Bill.com generated transactions so Bill.com can mark them as paid when you make a payment.

Other notes on the initial Bill.com sync with NetSuite:

-

Before completing the sync, ensure the AP aging report ties between the legacy system and NetSuite. Otherwise, Bill.com will generate the incorrect AP balance in NetSuite.

-

Bill.com recommends turning off mandatory segments during the import process.

-

The sync usually takes a few hours to complete but can take up to five business days, depending on the volume of transactions.

-

If loading historical transactions, I recommend disabling the Bill.com sync until the load to NetSuite is complete. This step will prevent historical transactions from syncing to Bill.com.

Integrations with 3rd party tools, like Bill.com, can impact the data migration plan and strategy. intheBlk consulting has the experience and expertise to advise you on preparing and executing a data migration strategy. Contact us or check out our other articles on our implementation resource page.