Are you looking for more tips, tricks, and how-to articles on reporting in NetSuite? Check out our NetSuite Reporting Resource page.

NetSuite, Reporting, Accounts Payable

January 10, 2024

3 min Read

NetSuite, Reporting, Accounts Payable

January 10, 2024

3 min Read

Are you an accountant looking to learn more about NetSuite's saved search capabilities? Enroll in my saved search course for accountants.

With the start of tax season comes preparing and filing 1099s. In NetSuite, the vendor record and the GL account combination are how 1099 activity is tracked. Users add the tax ID within the vendor record and enter if the vendor is 1099 eligible or not. Users enter the 1099 category on the GL account record.

NetSuite discontinued its 1099 reporting functionality in version 18.2. Instead, NetSuite is encouraging the use of 3rd-party tools for reporting. Suggested vendors include Sovos and Track 1099.

Here are a few tips and suggestions for NetSuite users preparing 1099's:

Create a 1099 Vendor Saved Search for reviewing vendor eligibility: build a Saved Search to display vendors with activity in the current year that shows their tax ID and whether they are 1099 eligible. As a reminder, sole proprietors, partnerships, and LLCs receive 1099s. C-corps and S-corps do not. A review trick is to check the W-9 for any vendor that includes LLC in the name.

Related Article: Build a NetSuite saved search for reviewing accounts payable.

Create a 1099 Account Saved Search for reviewing accounts marked as 1099 activity: Like the above search, quickly review GL accounts and their appropriate 1099 box. An excellent trick for pass-through costs, like reimbursed parking or meals, is to set up a GL account for consulting-pass-through costs. Then, don't mark this account as 1099-eligible.

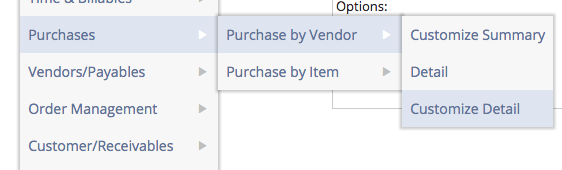

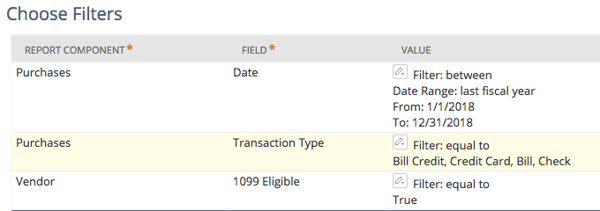

Leverage NetSuite's 'Cash Basis' reporting option: NetSuite gives the possibility to report on a cash basis when building reports. Combine this functionality with the 'Purchases -> Purchases by Vendor -> Detail' canned report with a filter to include only 1099 eligible vendors to see the cash activity of 1099 vendors. Combine this with the 1099 account saved search for a helpful report to review the coding of vendor activity.

1099 compliance is an annual process every accounting team needs to complete. Leverage NetSuite's capabilities with these tips to make compliance as easy as possible.

Are you looking for more tips, tricks, and how-to articles on reporting in NetSuite? Check out our NetSuite Reporting Resource page.

NetSuite, Reporting, Accounts Payable

January 10, 2024

NetSuite, Budgeting, Reporting

January 10, 2024

Financial Reporting, Budgeting, Reporting

January 10, 2024

NetSuite, Administration, Internal Controls

January 10, 2024

Financial Reporting, NetSuite, Reporting

January 10, 2024

Financial Reporting, Financial Statement Audit, NetSuite

January 10, 2024