How to find the transaction count from your legacy system

Implementation, Data Migration, Planning

April 24, 2024

Implementation, Data Migration, Planning

April 24, 2024

NetSuite, Implementation, Data Migration

February 19, 2024

NetSuite, Implementation, Data Migration

April 29, 2024

NetSuite, Implementation, Data Migration, QuickBooks

February 13, 2024

NetSuite, Implementation, Data Migration

February 15, 2024

NetSuite, Implementation, Data Migration

February 12, 2024

Implementation, Data Migration, CSV Uploads

February 12, 2024

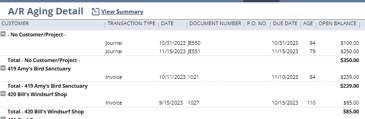

NetSuite, Implementation, Data Migration, Planning, Accounts Receivable

February 6, 2024

NetSuite, Implementation, Data Migration, Planning

January 9, 2024

Financial Reporting, NetSuite, Reporting

March 19, 2024

Implementation, CSV Uploads, GL Accounts

January 10, 2024

NetSuite, Data Migration, CSV Uploads

January 10, 2024

NetSuite, Implementation, Data Migration, Planning

April 27, 2024

NetSuite, Data Migration, CSV Uploads

February 15, 2024

Technology, Procurement, Biotech Industry

May 8, 2023